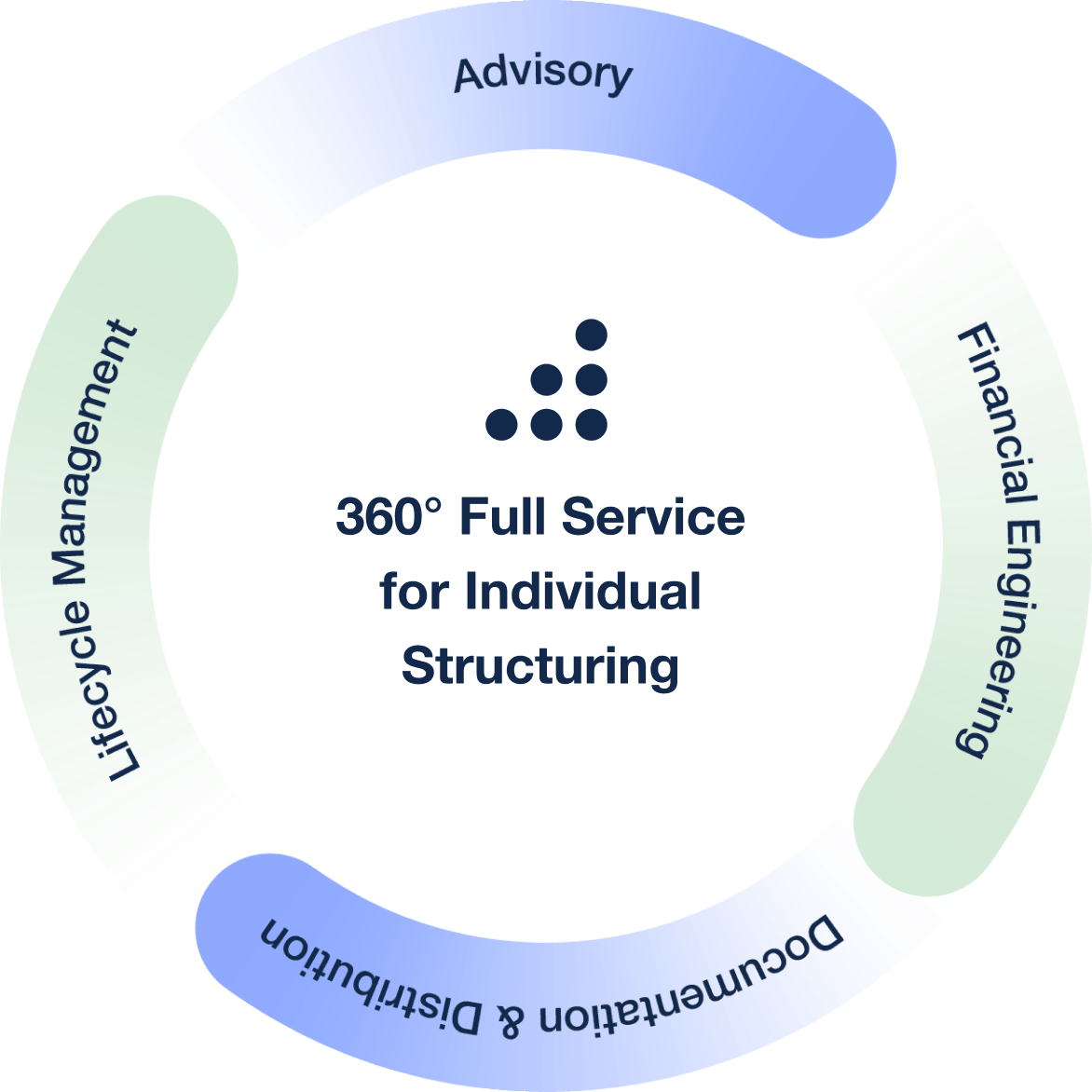

360° Service for Certificates & Structured Notes

From product idea and structuring to digital lifecycle support: Picard Angst offers institutional clients in Germany a complete service package – individually tailored, efficiently implemented, and BaFin-compliant.

With over 20 years of experience, we combine independent advisory, bespoke financial engineering, and digital transparency into a seamless process – all from a single source.

From client needs to product idea

Together with your institution’s designated contacts, we first clarify requirements, objectives, and expectations for a potential investment product. Based on this, we derive initial product ideas and thus create the foundation for targeted structuring – efficient, clear, and transparent.

From idea to structured solution

Building on the developed product idea, we design the structure in detail. This includes comparing different payoff mechanisms, analyzing opportunities and risks, and negotiating optimal terms with selected issuers. Our structured approach allows you to evaluate various scenarios – clearly understandable and tailored to your specific objectives.

From structure to market-ready product

For each product, our clients receive both a House View Package and an Advisor Package.

The House View Package summarizes target market, issuer, and underlying information in a suitable format. The Advisor Package contains product information designed to support advisors in client meetings

Support throughout the entire product lifecycle

After finalizing the product, we accompany you through all stages of the lifecycle – from coordinating settlement with the custodian bank to repayment or rollover.

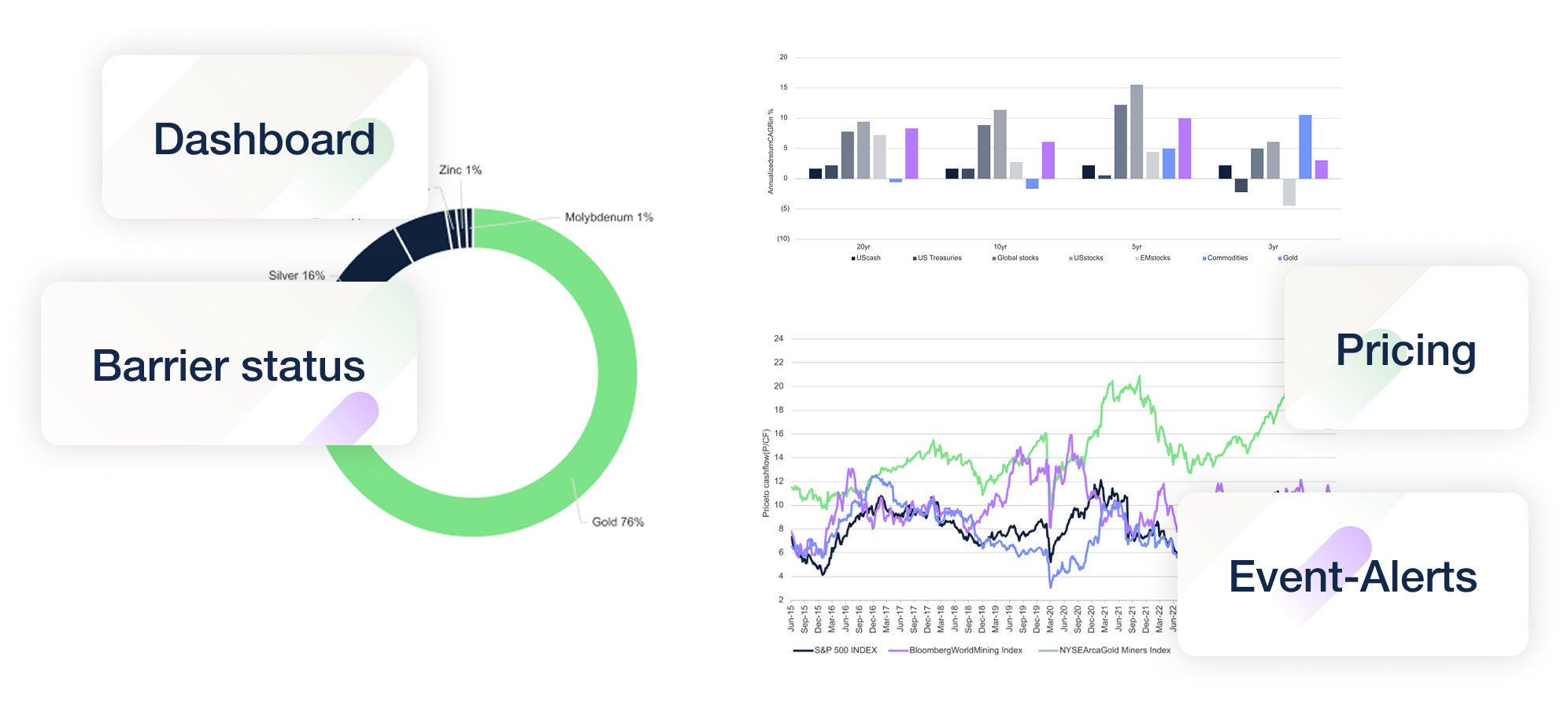

Through our digital lifecycle platform “Inside”, you maintain full transparency of your portfolio at all times, including key figures, events, and documents. We monitor coupon payments, redemption dates, and corporate actions, and support you in planning and implementing successor solutions.

Current offers and ideas

Whether interest-bearing notes, capital-protected certificates, reverse convertibles, discount certificates, or memory express airbag structures – talk to us, and we will implement investment solutions tailored to your needs.

Your Advantages

Independent Advisory

Wide network of issuers – solutions based solely on your needs.

Tailored Engineering

We design products according to your requirements.

Regulatory Security

Based in Switzerland with BaFin-compliant issuances for the German market.

Digital Lifecycle Platform

Always keep track of your certificates and structured products – clearly arranged, centralized, and in real time. Monitor barriers, express levels, upcoming coupon payments, and access all product documents. Portfolio and product views can be exported as PDFs at any time.

Our expertise in the professional development of bespoke structured products has been convincing institutional clients in Germany for over 20 years.

Trust in Us