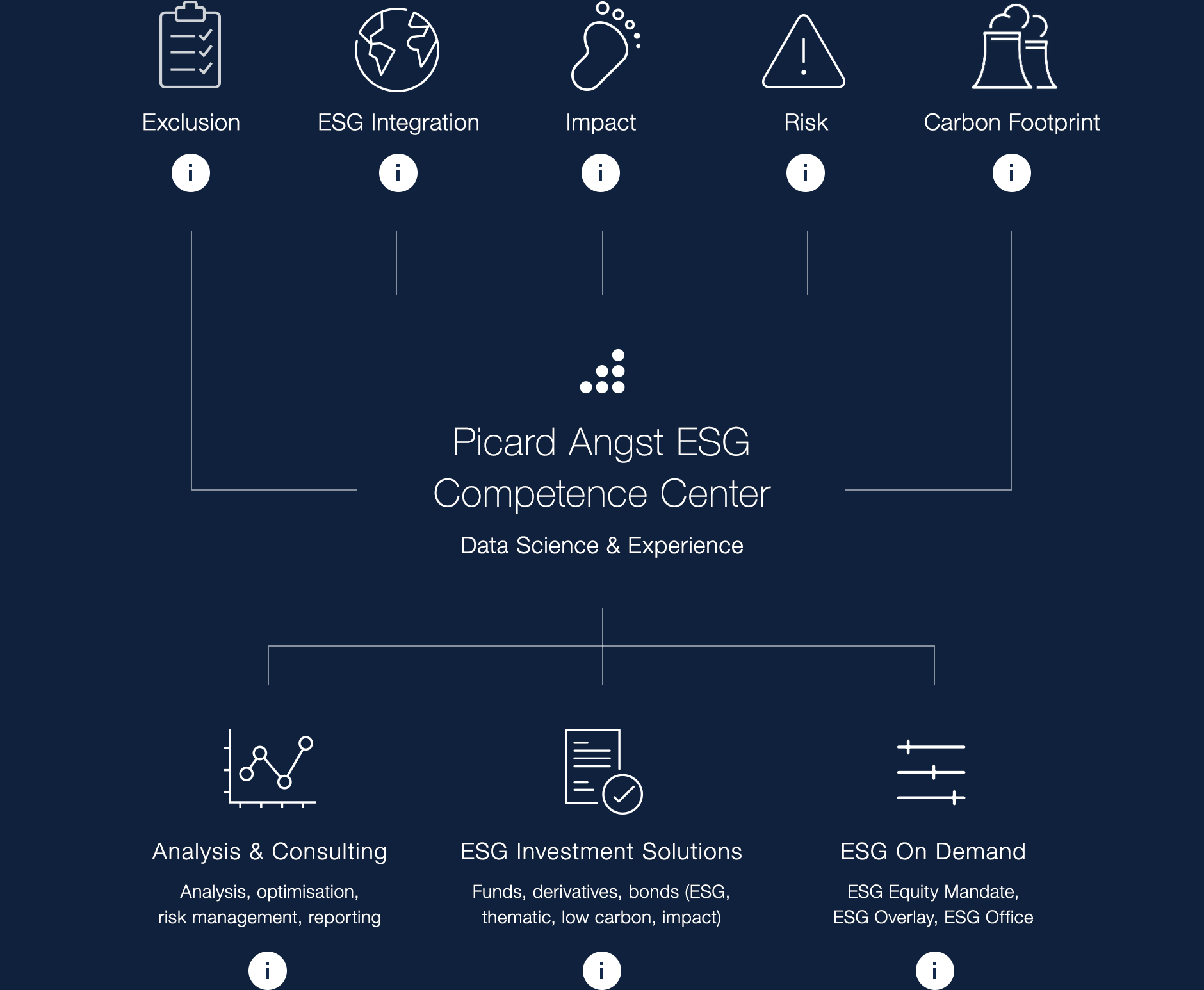

ESG Competence Center

Analysis & consulting, investment solutions and on-demand services. The Picard Angst ESG Competence Center supports institutional investors and financial service providers with individual ESG investment solutions and services. From strategy and optimisation to taking on the ESG office.

ESG Update 4/2024

Wie können Portfolios klimafreundlich ausgerichtet werden? Machen Sie unseren kostenlosen Klima Check und lernen Sie unsere ESG+ Strategien kennen.

ESG Study

Picard Angst's ESG study analyses the climate profile of institutional investor portfolios and provides a data-based analysis to support more climate-friendly portfolio decisions.

A modular, scalable ESG approach

The Picard Angst ESG Competence Center’s expertise allows you to simply and flexibly combine your individual investment strategy with the ESG strategy to support your success. The result can be obtained as a mandate, product or service. You choose the modules. We ensure that they are implemented successfully.

Picard Angst ESG+ Overlay

The Picard Angst ESG+ overlay focuses on optimising a portfolio’s sustainability profile through the systematic, risk-optimised integration of ESG criteria while simultaneously ensuring a controlled tracking error compared to the underlying benchmark.

Picard Angst Swiss Equities ESG+

Picard Angst World Equities ESG+

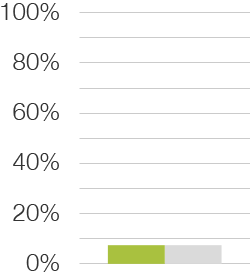

Picard Angst Swiss Equities ESG+

With Picard Angst's ESG+ overlay on the SPI index, you benefit from an enhanced ESG profile and higher returns for comparable risk.

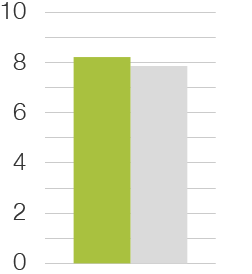

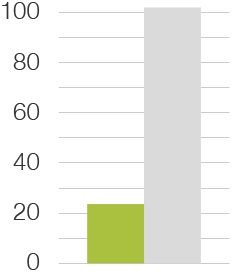

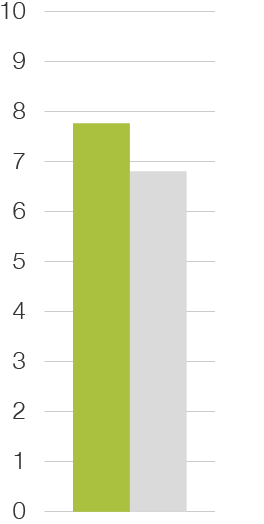

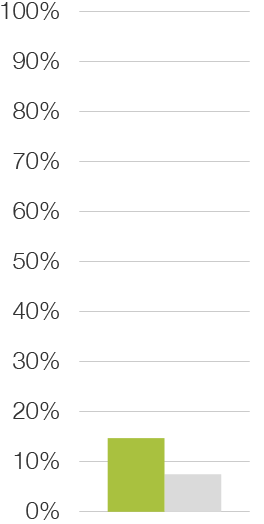

ESG Score

The ESG score measures the portfolio’s medium to long-term ability to manage the most significant risks and opportunities resulting from environmental, social and governance factors. It is based on the MSCI ESG ratings and is measured on a scale from 0 to 10 (0 being the worst).

+4.7%

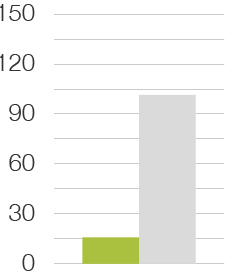

Carbon Footprint

The carbon footprint meaures involvement with carbon-intensive companies. It is based on MSCI carbon metrics and is calculated as a portfolio-weighted average of the companies’ carbon intensity. Carbon risk is classified according to the following categories: very low (0 to <15), low (15 to <70), moderate (70 to <250), high (250 to <525) and very high (>=525)

-77.8%

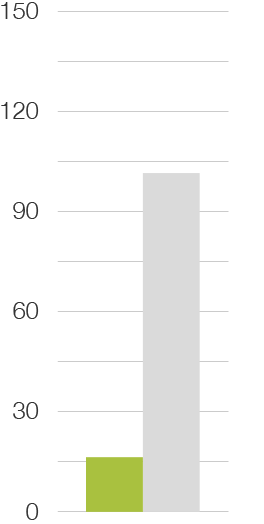

Revenue Impact

Revenue impact measures the percentage of revenue derived from products and services that contribute to solving the world’s biggest social and environmental challenges. These include basic needs, empowerment, climate change and resources. The calculation is based on the MCSI Sustainable Impact methodology.

+0%

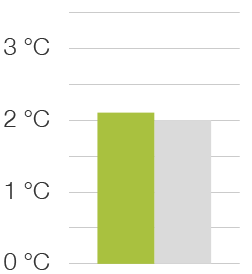

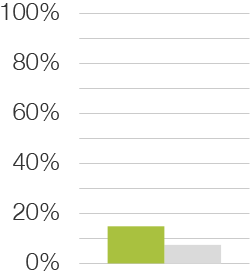

Temperature

The temperature target shows the extent to which the portfolio contributes to global warming or reduces the likelihood of achieving the 2-degree target by 2050. The rating is based on the MCSI methodology.

+0.1°C

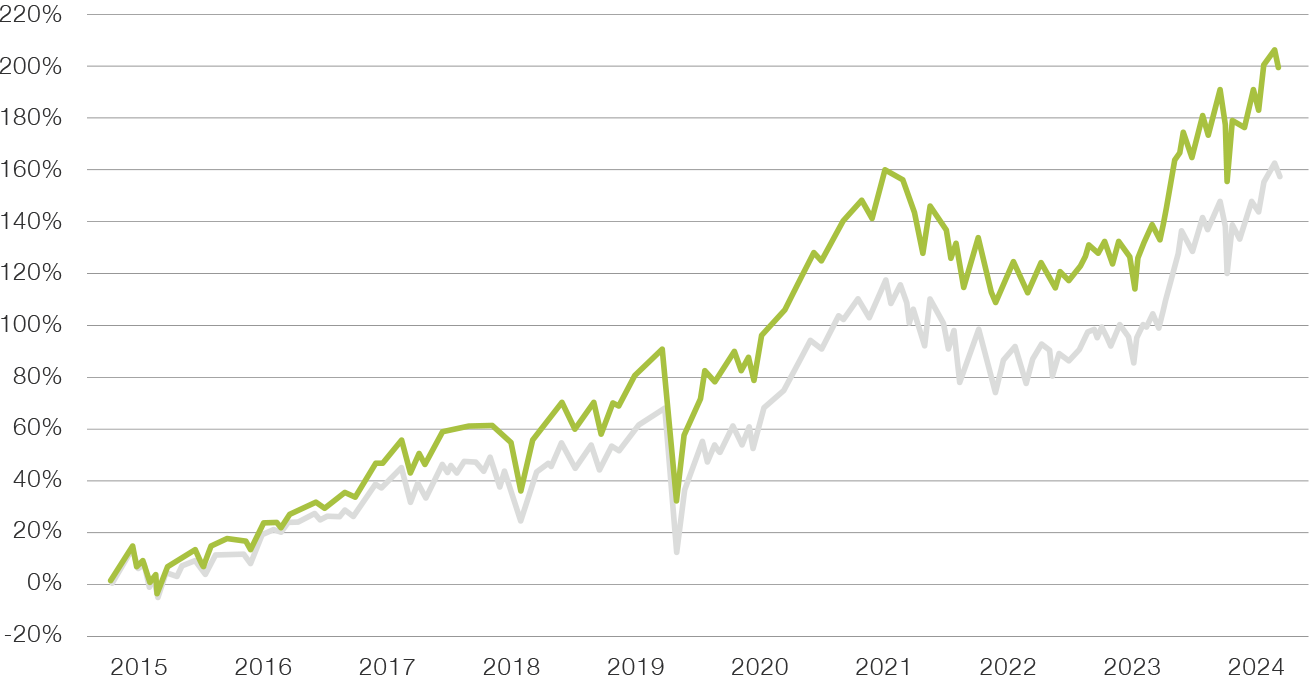

- Picard Angst Swiss Equities ESG+

- SPI Index

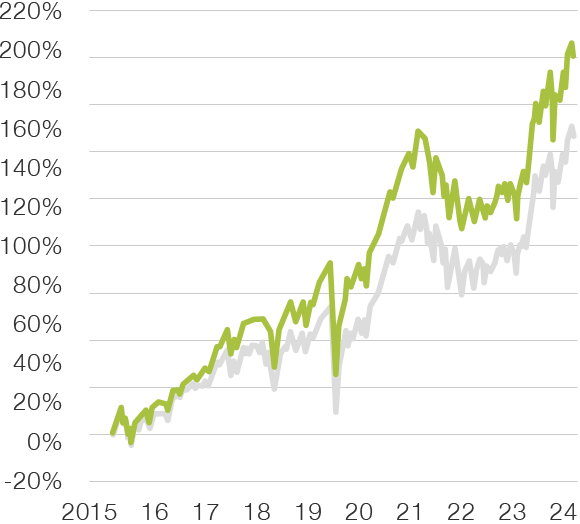

Outperformance

Shows the annualized outperformance since launch between the strategy and the benchmark index.

+0.6%

Volatility

Shows fluctuations in the financial market.

13.8%

Tracking error

Deviation between the performance of the strategy and the benchmark.

0.67

Sharpe Ratio

Shows the excess return over the risk-free interest rate in relation to volatility.

0.58

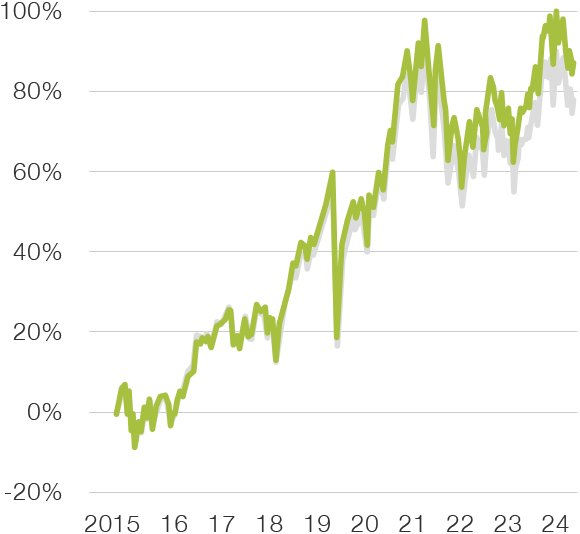

- Picard Angst Swiss Equities ESG+

- SPI Index

Simulated data 30.09.2014 – 31.12.2019 and live data from 1.1.2020 to 04.02.2025

Source: Bloomberg, MSCI

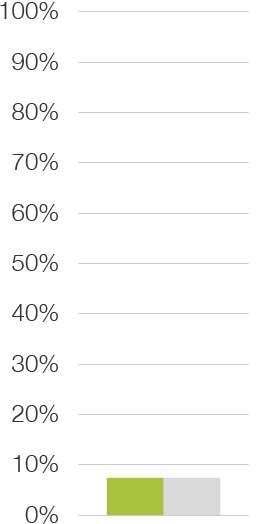

Picard Angst World Equities ESG+

With Picard Angst's ESG+ overlay on the MSCI World ex Switzerland, you benefit from an improved ESG profile and higher returns with comparable risk.

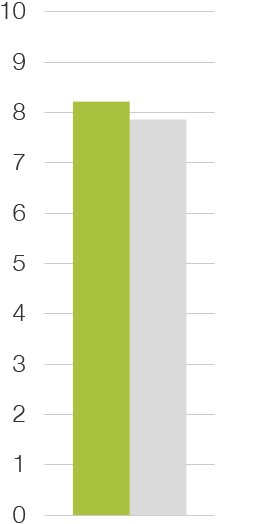

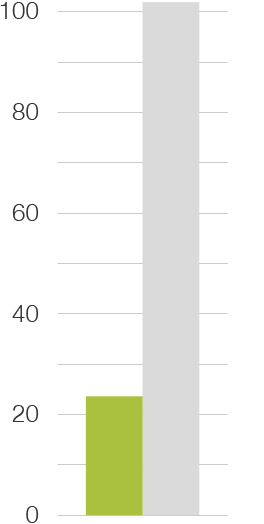

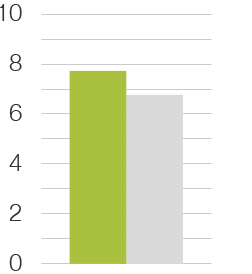

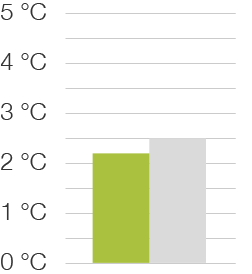

ESG Score

The ESG score measures the portfolio’s medium to long-term ability to manage the most significant risks and opportunities resulting from environmental, social and governance factors. It is based on the MSCI ESG ratings and is measured on a scale from 0 to 10 (0 being the worst).

+14.7%

Carbon Footprint

The carbon footprint meaures involvement with carbon-intensive companies. It is based on MSCI carbon metrics and is calculated as a portfolio-weighted average of the companies’ carbon intensity. Carbon risk is classified according to the following categories: very low (0 to <15), low (15 to <70), moderate (70 to <250), high (250 to <525) and very high (>=525)

-84.5%

Revenue Impact

Revenue impact measures the percentage of revenue derived from products and services that contribute to solving the world’s biggest social and environmental challenges. These include basic needs, empowerment, climate change and resources. The calculation is based on the MCSI Sustainable Impact methodology.

+7.4%

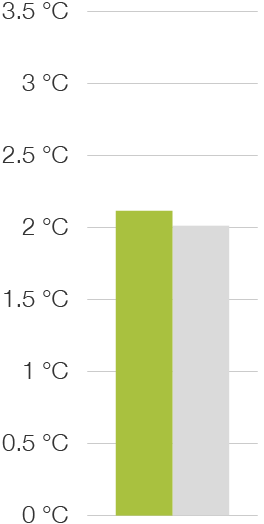

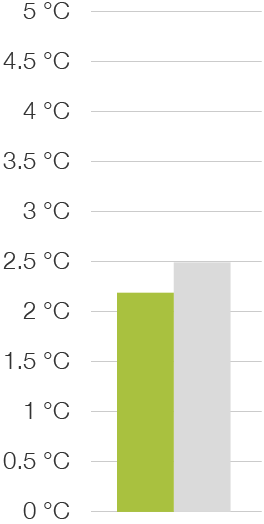

Temperature

The temperature target shows the extent to which the portfolio contributes to global warming or reduces the likelihood of achieving the 2-degree target by 2050. The rating is based on the MCSI methodology.

-0.3°C

- Picard Angst World Equities ESG+

- MSCI World ex Switzerland Net Total Return CHF Index

Outperformance

Shows the annualized outperformance since launch between the strategy and the benchmark index.

+1.89%

Volatility

Shows fluctuations in the financial market.

16%

Tracking error

Deviation between the performance of the strategy and the benchmark.

1.91

Sharpe Ratio

Shows the excess return over the risk-free interest rate in relation to volatility.

0.7

- Picard Angst World Equities ESG+

- MSCI World ex Switzerland Net Total Return CHF Index

Reference currency: CHF

Simulated data 30.09.2014 – 31.12.2019 and live data from 1.1.2020 to 04.02.2025

Source: Bloomberg, MSCI

Our ESG services

Picard Angst ESG Competence Center provides systematic, data-based financial engineering and consulting services. With our cloud-based database of fundamental and ESG data on more than 7,000 equities, we use artificial intelligence to support you in the areas of

ESG Analysis

We support you with a data-driven ESG analysis of your portfolio or your strategy.

ESG Optimisation

ESG score, carbon footprint, impact, temperature: we optimise the desired dimensions.

ESG Reporting

We manage your ESG monitoring and reporting in your chosen format.

ESG Overlay

Our ESG Overlay allows you to take a systematic and risk-optimised approach to integrating ESG criteria.

ESG Mandate

In the context of mandates, we develop tailored, individual ESG solutions for you.

ESG Office

Entrust some or all of your ESG tasks to us as part of an outsourcing arrangement.

“With our Competence Center for sustainable investments, our ambition is to lead the Swiss independent asset management sector in ESG solutions.”

Daniel Gerber, Head of Business Development

Picard Angst ESG solutions

The Food Revolution Fund

The Food Revolution by Picard Angst is a global equity fund that aims to profit from the structural changes in the food industry. To this end, investments are made in 40 to 60 listed stocks along the value chains of six to ten structurally strongly growing segments. The PA ESG Layer ensures that stocks with the highest ESG risks and serious controversies are excluded, international standards on human rights, labour law, environmental protection and corruption are complied with, and controversial business activities are avoided or excluded.

Sustainable Infrastructure Bonds "Health Care"

Our private market bond programme offers access to sustainable bonds with impact investing character. The aim is to finance infrastructure projects in the field of health care together with partners. These projects are characterised by the fact that they make a measurable contribution to one or more of the UN's sustainable development goals.

Sustainable Infrastructure "Logistics"

Our private market bond programme offers access to sustainable bonds with impact investing character. The aim is to finance infrastructure projects in the field of logistics together with partners. These projects are characterised by the fact that they make a measurable contribution to one or more of the UN's sustainable development goals.

“As a member of PRI, an international initiative for responsible investing, we integrate ESG considerations relating to environmental impact, social aspects and governance into all our investment decisions, as long as they align with the respective investment strategy.”

David-Michael Lincke, Head of Portfolio Management

Your contacts

Daniel Gerber

Head of Desk Switzerland

+

Sivapriya Kumar

Senior Portfolio Manager

+

Clemens Struck

Head of Data Science

+

Agnes Rivas

Senior Client Advisor Sustainability

+

Dina Taslimi

Marketing Manager

+

Important legal information:

We would like to inform you that telephone calls made to our phone lines are recorded. We assume that you are in agreement with this when you call.

This presentation draft represents a future project from Picard Angst. It is not an offer or invitation to buy or sell securities. It is intended for informational use only. Investments should only be made after the fund documentation in question has been read thoroughly. This presentation does not contain binding information; the offer documentation is the sole legally binding documentation.

The “Directives on the Independence of Financial Research” from the Swiss Bankers Association do not apply to this presentation. We wish to make you aware that it cannot be excluded that Picard Angst AG has a vested interest in the development of the price of individual titles or all the titles listed in this document.

The value and returns of the shares can increase or decrease. They are influenced by market volatility and currency fluctuation. Picard Angst AG accepts no liability for any losses. Past performance of values and returns is no indicator of ongoing and future performance. The performance of values and returns does not take into account any charges and fees incurred upon purchase, redemption and/or exchange of the shares. The allocation by country, currency and individual items, and any benchmarks stated, can change at any time within the framework of the investment policies stated in the legal prospectus.

All statements can be changed without prior notice. Statements can differ from estimates given in other documents published by Picard Angst AG, including research publications. Neither the entire document nor parts thereof may be reused or redistributed. While Picard Angst AG is of the opinion that the information included herein draws on reliable sources, Picard Angst cannot guarantee the quality, accuracy, validity or completeness of the information contained within this document.

If the fund, partial fund or share class is not registered for public offer and sale, the sale of shares can only be undertaken within the framework of private placements, or in the institutional domain, with regard to applicable local laws. The fund may not be sold in the USA nor to US citizens, neither directly nor indirectly.

Picard Angst AG is an asset manager handling collective capital investments pursuant to the Federal Law on Collective Capital Investments and is subject to the oversight of the Swiss Financial Market Supervisory Authority.