Detailing on a modern detached house. GOPIXA ISTOCK GETTY IMAGES PLUS

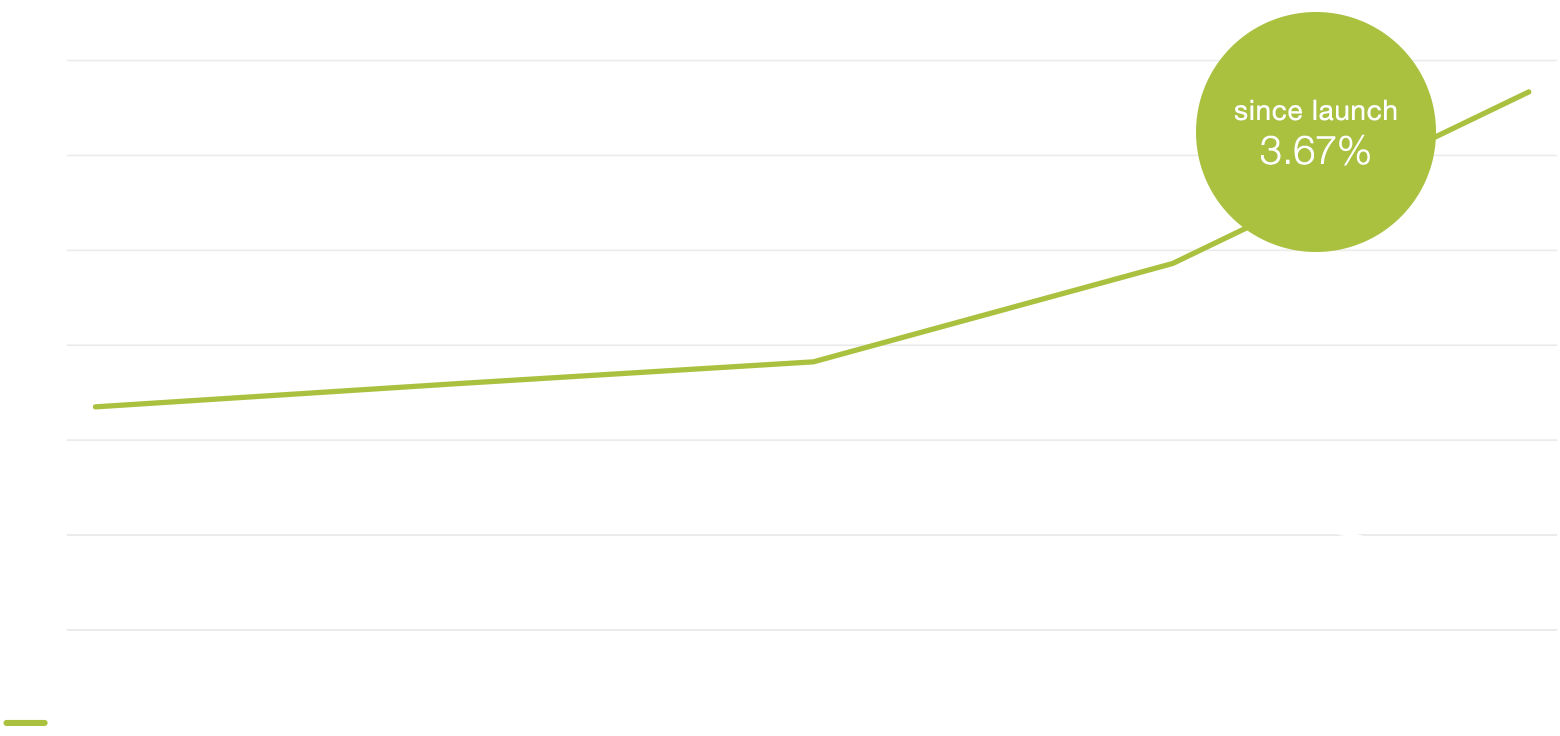

Growing Yield advantages with Swiss Residential Mortgages

Given the low interest rate environment at the moment, it is barely possible to generate positive returns with bonds. As a result, Picard Angst uses Swiss Residential Mortgages to offer an attractive alternative, via the investment foundation avenirplus. By financing mortgages, primarily on residential properties in Switzerland’s Mittelland region, it is possible to generate yield advantages while keeping risk levels low.

Yield advantages with mortgages

"Our rigorous selection process leads to an outstanding risk/return profile."

Marco Fumasoli, Head of Asset Management

Product information

Avenirplus’ Swiss Residential Mortgages finances first mortgages secured by rights of lien, preferably on residential properties within Switzerland’s Mittelland region. It focuses on financing mortgages at fixed interest rates for borrowers with top-class credit ratings. All the properties are automatically insured against earthquakes.

Swiss Residential Mortgages

| NAV | CHF 1,035.753 |

| Investment group assets (millions) | CHF 161.10 |

| Launch date | 1 Sept 2016 |

| ISIN | CH0371635027 |

| Custodian bank | Credit Suisse |

| Supervision | OAK |

| Investment Manager | Investas AG, Bern |

| Auditors | BDO AG |

| TER KGAST | 0.41% |

| Annualised volatility | 0.54% |

| Modified Duration | 4.87 |

Pledged properties

| residential | |

| commercial | |

| liquidity |

Borrowing levels

| encumbered | |

| clear |

Types of mortgage

| fixed interest | |

| LIBOR | |

| liquidity |

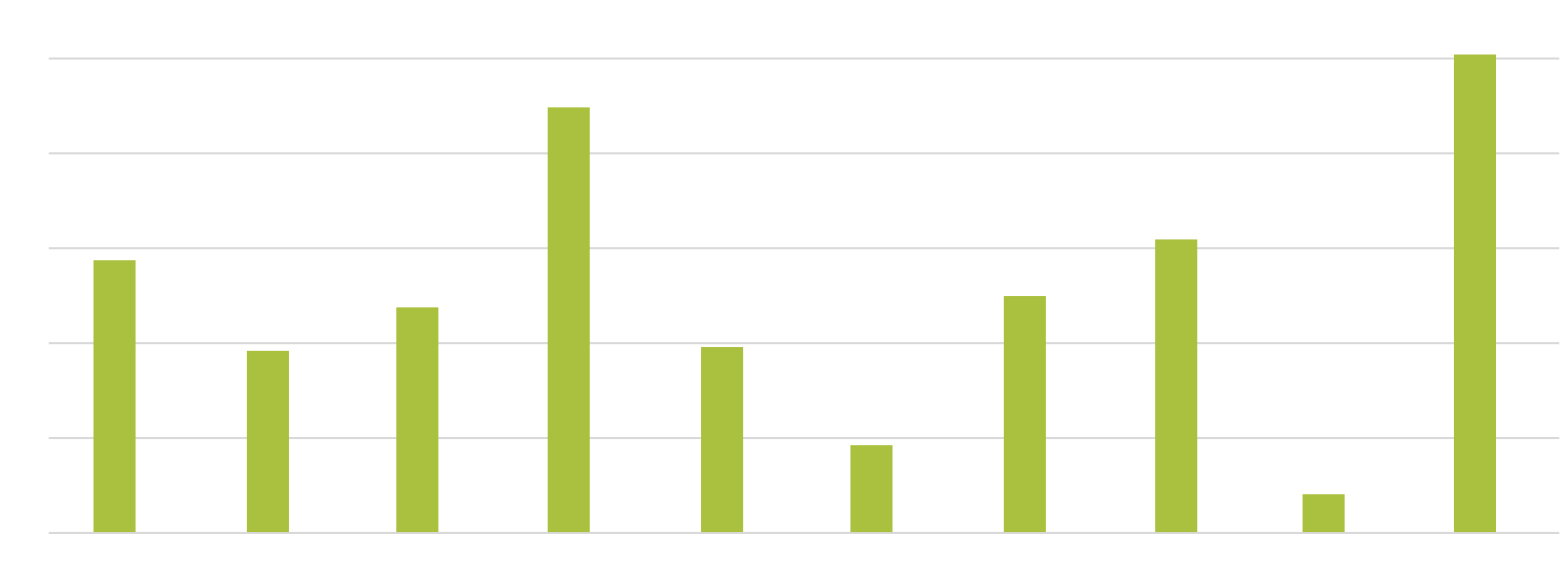

Maturity structure

Success in the Mittelland region since 1998

The avenirplus investment foundation offers sustainable, collective forms of investment for Swiss pension funds, independent of banks and insurance companies. It currently manages CHF 500 million, and boasts an outstanding network in Switzerland’s Mittelland region as part of the v.Fischer Investas Group, founded in 1873.

Six good reasons for your investment

Yield advantages

Swiss Residential Mortgages offer more attractive potential in terms of returns than bonds.

Low volatility

Fluctuations in value are utterly minimal, even within a volatile environment.

Low borrowing rates

At 40%, the borrowing rate is more than 25% less than the statutory maximum.

Fixed interest rates

More than 90% of the mortgage receivables are assigned at fixed interest rates.

Creditworthiness

All the mortgagees have top-class credit ratings, as calculated by avenirplus’ specialists.

Safety

The safety level corresponds to AAA bonds, and all the properties are insured against earthquakes, too.

Your contact

Christoph Beck

Senior Client Advisor Market Switzerland

+

Legal disclaimer

Important legal information: Please note that telephone calls are recorded and whenever you call us we shall assume that we have your consent to this.

This does not constitute advice, an offer or an invitation to buy or sell financial products. It is for informational purposes only. Investments should only be made after thorough reading of the relevant documents. The statutes, the foundation regulations, the fee & cost regulations, the prospectus, the investment and financing guidelines as well as the corresponding fact sheet of the Steiner Investment Foundation are available from the Steiner Investment Foundation. This website does not contain any binding information and the only legally binding documentation is the prospectus.

Picard Angst AG assumes no liability for any losses. Past performance is not an indicator of current or future performance. The value and yield development does not take into account any costs and fees that may be incurred.

All statements are subject to change without notice. The statements may deviate from estimates made in other documents published by Picard Angst AG. Picard Angst does not guarantee the accuracy, completeness and timeliness of the published information and opinions.